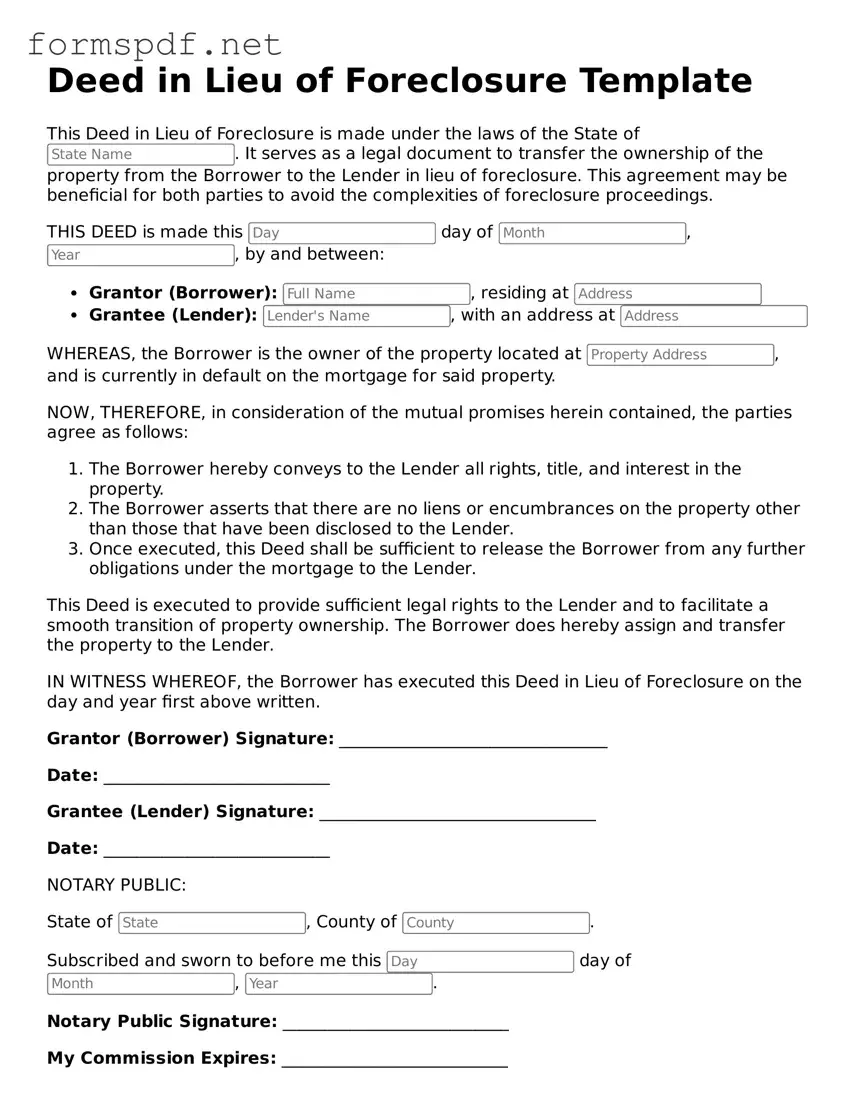

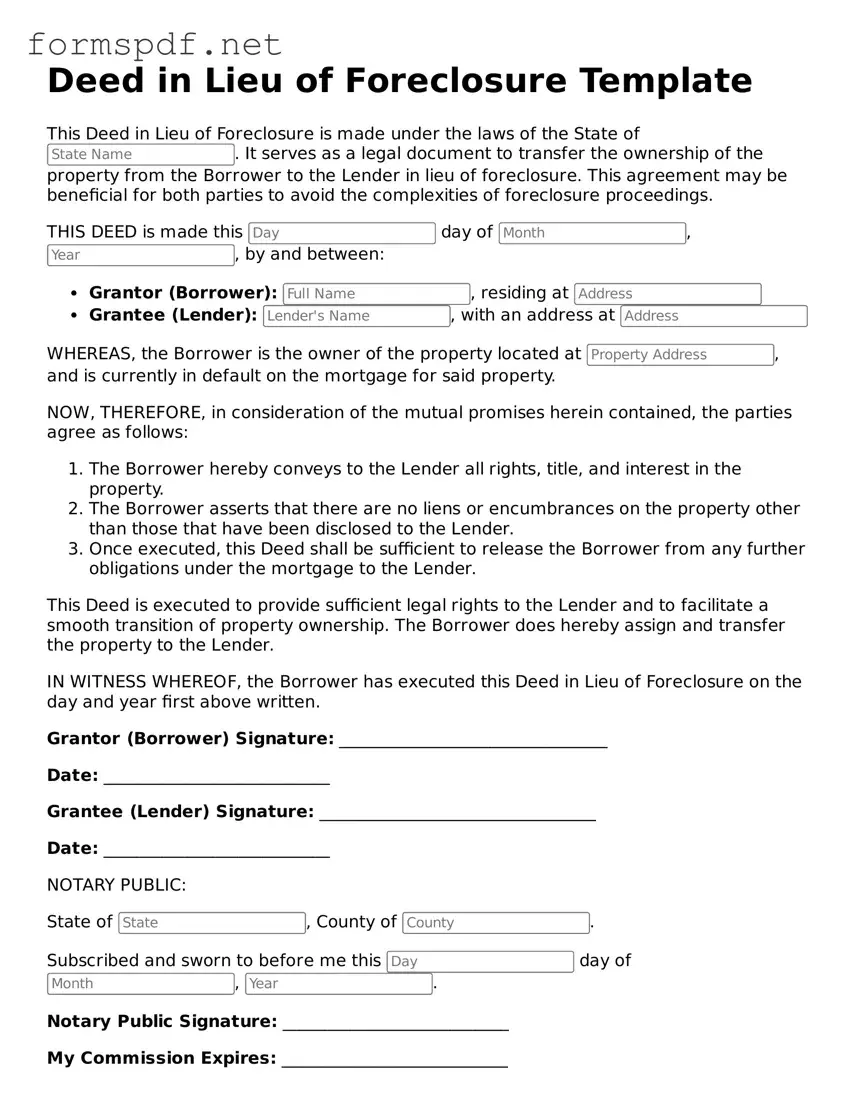

Fillable Deed in Lieu of Foreclosure Form

A Deed in Lieu of Foreclosure is a legal document that allows a homeowner to voluntarily transfer their property to the lender to avoid foreclosure. This process can simplify the resolution of mortgage default and help both parties move forward. If you're considering this option, take the next step by filling out the form below.

Launch Editor Now

Fillable Deed in Lieu of Foreclosure Form

Launch Editor Now

Launch Editor Now

or

⇓ Deed in Lieu of Foreclosure PDF

Don’t leave without finishing the form

Finish your Deed in Lieu of Foreclosure online and download the final version.